Did you know that, according to the Insurance Information Institute, roughly 60% of Americans have some sort of life insurance policy? However, an estimated 10%–20% of claims face an initial rejection or delay.

It is to allow families to have peace of mind and financial support in the event of the death of a loved one. Valid claims can still be rejected or denied by the insurer. This becomes a source of unnecessary confusion and stress when someone is dealing with grief.

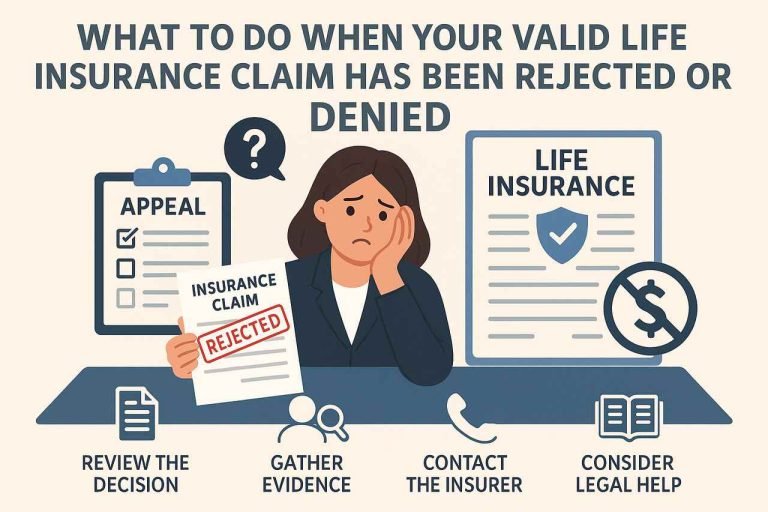

So what should you do if your insurer turns down your claim? First, understand the reason for the denial. Read the denial letter carefully. It may contain important information that will help you move forward.

A life insurance lawyer can also help you pursue your claim if you think it’s valid. Let’s explore the options that you have in facing this problem.

Understand the Reasons for the Denial

When life insurance claims are denied, you must know why. Disputes in insurance claims can be a result of your inability to make premium payments on time, the presence of incorrect information, or reasons associated with policy exclusions.

Frustration might set in, but this information can actively work for you. You may be denied for not disclosing your medical history or submitting the application late.

It is important to compile all documents relevant to your policy and the claim. When you spot the exact reasons for the denial, you can work toward fixing them. Your insurer would certainly support you through this, empowering you to face the difficult times ahead.

Review Your Policy Documents

Before taking additional steps, review your policy documents carefully. Review the coverage limits, exclusions, or particular conditions of your claim. After the conditions are clear for you, you will be able to find any instance where mishandling took place.

Check to see if you’ve met all the requirements in your policy. Being rejected could be based on a few mistakes or a misreading of the policy language. Understanding insurance terminology will help you have a deeper understanding of insurance companies when discussing your claim, which will strengthen your case.

Gather Supporting Evidence

Collecting evidence after a denial of a life insurance claim becomes a requirement. Collection of policy documentation, such as the application and communications with the insurance company. Medical records, death certificates, and several other documents could clarify the allegation.

Get witness statements or expert opinions that might be aligned with your claims. Your claim will get more credible when you have solid proof at hand. At such a time, try to get help and encouragement from your friends whom you trust or from a good support group. Understand your situation.

File an Appeal With the Insurance Company

With the supporting evidence at hand, file an appeal with the insurance company. This would give you a chance to plead your case once again, with the view that your claim is valid.

Assess each of the reasons from this standpoint and respond to it accordingly in the appeal. The appeal must be clear and concise and must also include all relevant paperwork that would support the arguments being mentioned. You must comply with the specific appeal procedure of the company and the time frame in relation to that procedure.

Pursuing an appeal means that you are fighting for yourself and your voice to be heard. Strive for success and never hesitate to seek assistance.

Seek Legal Assistance if Necessary

If your appeal has failed, you will need legal support. An expert will protect your rights and help with insurance law. They will understand your insurance policy well enough to recognize misinterpretations by an insurer. They will make you aware and support you in fighting against the insurance company.

Their assistance can reduce the stress of the situation. Receiving legal counsel will help you feel connected during such an isolating process.